Type of Payment

In Singapore, purchasing a resale or a property under construction or an Executive condo have different payment scheme.

There are progressive payment, Deferred payment and direct payment. Deferred payment is only applicable for New Executive Condo. For new property purchase directly from the developer or homeowner, as long as the unit is completed, it will be Direct payment.

Assuming you qualified for the max 80% loan, you will need to pay 20% downpayment which will have the different break down for the different property type.

1) Property Under Construction

2) Re-sale/TOP Property

3) Executive Condo (Defer payment Scheme)

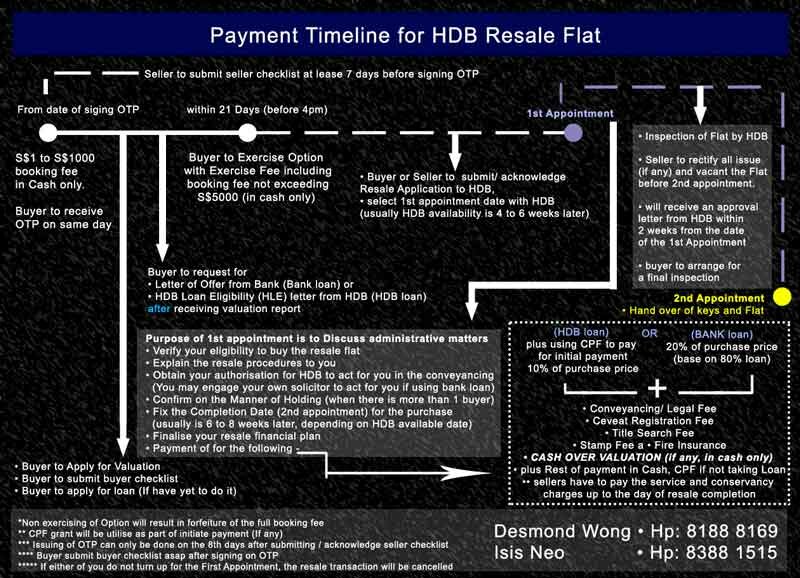

4) Payment Timeline for HDB

Property Under Construction

Your payment schedule will depend on the progress of the construction stages. This also applies to the buyer of Executive Condo not opting for deferred payment and buyer of the private condo under construction.

| Stages | Payment | Duration (estimate) | Term |

|---|---|---|---|

| Booking Fee | 5% | Upon booking | Cash only |

| Balance Payment | 15% | 8 weeks from booking | Cash and/or CPF |

| Completion of Foundation | 5% | 6 to 9 months from launch | Cash and/or CPF |

| Completion of Foundation | 5% | 6 to 9 months from launch | Instalment plan or lump sum Payment at this stage |

| Completion of the reinforced concrete framework | 10% | another 6 to 9 months | Instalment plan or lump sum Payment at this stage |

| Completion of the partition wall of units | 5% | another 3 to 6 months | Instalment plan or lump sum Payment at this stage |

| Completion of roof/ceiling of units | 5% | another 3 to 6 months | Instalment plan or lump sum Payment at this stage |

| Completion of door/window frame and electric wiring etc | 5% | another 3 to 6 months | Instalment plan or lump sum Payment at this stage |

| Completion of the car park, drain, the road serving the housing project | 5% | another 3 to 6 months | Instalment plan or lump sum Payment at this stage |

| Completion of the car park, drain, the road serving the housing project | 5% | another 3 to 6 months | Instalment plan or lump sum Payment at this stage |

| Collection of Temporary Occupation Permit (TOP) or certificate of statutory completion | 25% | Collection of keys | Instalment plan or lump sum Payment at this stage |

| Payment upon Certificate of Statutory Completion (CSC) | 15% | 1 year after TOP | Instalment plan or lump sum Payment at this stage |

Payment Timeline for property direct from the developer

*Note- Stamp fee, Lawyer fee etc is not included in the illustration.

** The 1st 5% in cash only, and is base on the purchase without any current mortgage loan. For purchaser still having to service mortgage loan at point exercising the Sales and Purchase Agreement, first 25% must be in cash (Not able to utilise CPF)

***Max loan amount is 75% of the purchase price

Resale/TOP property

| Stages | Payment | Duration (estimate) | Term |

|---|---|---|---|

| Option Fee | 1% | Upon booking | Cash only |

| Exercise of Option | 4% | Within 14 days | Cash only |

| Balance payment | 20% | Within 8 weeks | Cash and/or CPF (For CPF usage, will need to pay in cash 1st then reimburse back after deduction from CPF account) |

| Balance Payment | 75% | Completion Date | Instalment plan or lump sum Payment in CPF and/or Cash |

Payment Timeline for resale and TOP property

*Note- Stamp fee, Lawyer fee etc is not included in the illustration.

** The 1st 5% in cash only, and is base on the purchase without any current mortgage loan. For purchaser still having to service mortgage loan at point exercising the Option to Purchase/Sales and Purchase Agreement, first 25% must be in cash (Not able to utilise CPF)

***Max loan amount is 75% of the purchase price.

Executive Condo (Deferred Payment)

| Stages | Payment | Duration (estimate) | Term |

|---|---|---|---|

| Booking Fee | 5% | Upon booking | Cash only |

| Exercise of Option | 15% | Within 9 weeks | Cash and/or CPF |

| Collection of Temporary Occupation Permit (TOP) or certificate of statutory completion | 65% | Collection of Keys | Instalment plan or lump sum Payment |

| Payment upon Certificate of Statutory Completion (CSC) | 15% | 1 year after TOP | Instalment plan or lump sum Payment |

Payment Timeline for Executive Condo

*Note- Stamp fee, Lawyer fee etc is not included in the illustration.

Payment Timeline for HDB

| Stages | Payment | Duration (estimate) | Term |

|---|---|---|---|

| Booking Fee | $1 to $1000 | Upon booking | Cash only |

| Exercise of Option | Up to $5000 including booking fee | Within 21 days | Cash only |

| 1st appointment (HDB Loan) | Initiate 10% or more | Estimate 4 to 6 weeks | Cash, CPF and/or Grant (if any) |

| 1st appointment (Bank Loan) | Initiate 25% or more | Estimate 4 to 6 weeks | Cash, CPF and/or Grant (if any) |

* Note: The balance amount after initial payment will be payable in Cash, CPF and/or Instalment.

Cash Payment, from 28 August 2013

- The cash payment is computed based on purchase price or the current market valuation of the flat, whichever is the lower.

- Existing property owners are considered as having no outstanding residential property loans as they must dispose of their existing property within 6 months from their next HDB flat or EC purchase.

Loan Ceiling (Bank Loan), from 06 July 2018

For more details, please refer to MAS’s press release on 5 July 2018.

Temporary Loan Scheme for HDB Flat with keys ready for collection

Temporary Loan Scheme

The Temporary Loan Scheme (TLS) helps flat buyers who intend to use the sale proceeds from their existing flat to pay for their new flat, without taking a mortgage loan. You can apply for a temporary loan to complete the new flat purchase first, while the sale of your existing flat is underway. You will then redeem the temporary loan using the net proceeds from the sale of your existing flat.

Eligibility conditions

To qualify for the Temporary Loan Scheme, you must have:

- Booked a new flat and the keys are now ready for collection

- Submitted an application to sell the existing flat

- Sufficient CPF/ cash proceeds from the sale of the existing flat to fully redeem the temporary loan

Once the temporary loan is approved, you will be invited to collect the keys to the new flat after your resale first appointment. The temporary loan will be offered at the prevailing non-concessionary interest rate. If the temporary loan amount (capped at the net sale proceeds) is not enough to complete the new flat purchase, you must top-up the shortfall in cash within the stipulated time period so that you can collect the keys to the new flat.

Application procedure

Please submit the Request Form for Temporary Loan form together with the resale application for your existing flat through MyDoc@HDB.

Source: HDB

Back to home page

Share this wonderful property Facebook, Twitter and Google+.